A parent company is a business entity that owns enough shares in another company to control its decisions and direction.

The parent company structure is widely used by businesses that operate through multiple legal entities, helping them manage control, risk, and strategy across a group.

Understanding what a parent company is and how it differs from a holding company is important for directors, compliance teams, and organisations operating within regulated markets. Group structures affect governance, reporting obligations, and how legal entities are identified for regulatory purposes, including through mechanisms such as the Legal Entity Identifier (LEI).

What Does a Parent Company Mean?

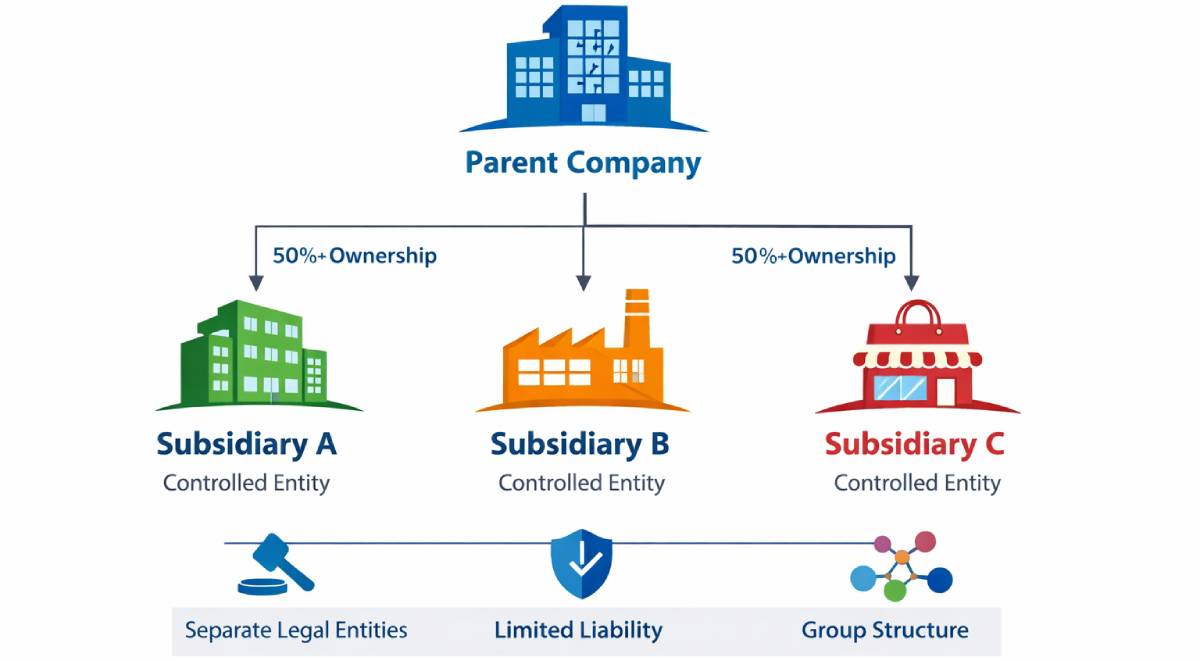

A parent company is a business that owns and controls one or more other companies, known as subsidiaries. This control is most commonly achieved by holding a majority of the subsidiary’s voting shares, which allows the parent company to influence key decisions such as strategy, management appointments, and long-term direction.

A parent company often plays an active role in shaping how the wider group operates. It may set group-wide policies, oversee financial performance, or coordinate activities across different subsidiaries. While the parent company has control, each subsidiary usually remains a separate legal entity, which is an important distinction for liability, governance, and regulatory purposes.

Many businesses adopt a parent company structure as they grow, acquire other companies, or expand into new markets. This approach allows organisations to maintain oversight and strategic control while keeping different business activities legally and operationally distinct.

Parent Company vs Subsidiary Relationship

A subsidiary is a company that is controlled by a parent company but remains a separate legal entity. This legal separation is a key feature of group structures and has important implications for liability, regulation, and reporting.

While a parent company can direct strategy and exert control, subsidiaries typically enter into contracts, employ staff, and hold assets in their own name. This separation can help limit financial and legal risk, as liabilities usually remain within the subsidiary rather than automatically transferring to the parent company.

In practice, the relationship between a parent company and its subsidiaries must be carefully managed. Governance arrangements, intercompany agreements, and reporting lines are essential to ensure the group operates effectively while respecting legal boundaries between entities.

What Is a Holding Company?

A holding company is a company that exists mainly to own shares in other businesses rather than to trade or provide services itself. While it is a type of parent company, its role is usually limited to ownership, control, and long-term oversight rather than day-to-day operations.

In a typical UK group structure, a holding company sits at the top of the group and owns one or more subsidiaries that carry out the actual business activities. This approach is often used to separate ownership from operations, manage risk more effectively, and keep different parts of the business clearly structured from a legal and governance perspective.

Holding companies are commonly used by UK groups with multiple trading entities, investment portfolios, or international operations. By keeping commercial activity within subsidiaries, the holding company can focus on strategy, asset ownership, and group governance without being directly exposed to operational liabilities.

Parent Company vs Holding Company: Key Differences

The difference between a parent company and a holding company lies mainly in operational involvement and purpose.

A parent company often plays an active role in the business, influencing or managing operations across the group. A holding company, by contrast, is typically passive, focusing on ownership and control rather than daily management.

Risk exposure also differs. Holding companies are often designed to limit exposure by keeping operational risk within subsidiaries. Parent companies that trade directly may be more exposed to commercial and regulatory risks, depending on how the group is structured.

Responsibilities of a Parent Company

A parent company has significant responsibilities, particularly when operating within a regulated environment. These responsibilities include oversight of subsidiaries, ensuring appropriate governance arrangements are in place, and maintaining effective internal controls across the group.

From a financial perspective, parent companies are often responsible for consolidated reporting. This means combining the financial results of subsidiaries into group accounts, which must accurately reflect ownership structures and control relationships.

Parent companies must also be aware of regulatory expectations, especially where subsidiaries operate in financial markets. Clear documentation of group relationships and decision-making authority is essential to meet compliance and disclosure requirements.

Parent Companies, Group Structures, and LEI Identification

Parent companies play an important role in how legal entities are identified within financial markets. The Legal Entity Identifier (LEI) system captures information about ownership and control, including relationships between parent companies and subsidiaries.

When a company is required to hold an LEI, details of its direct and ultimate parent may need to be reported. This helps regulators and market participants understand group structures, manage systemic risk, and improve business transparency.

Accurate parent–subsidiary information is therefore essential. Changes in ownership, mergers, or restructurings should be reflected promptly to ensure that LEI records remain up to date and consistent with the group’s legal structure.

Advantages and Disadvantages of Being a Parent Company

Being a parent company offers several advantages. It allows businesses to expand while maintaining control, manage risk by separating activities, and structure operations efficiently across different entities or regions.

However, there are also disadvantages. Group structures can increase complexity, lead to higher administrative costs, and create additional governance and compliance obligations. Parent companies must invest time and resources into oversight to ensure subsidiaries operate in line with group policies and regulatory expectations.

Careful planning is essential to ensure that the benefits of a parent company structure outweigh the operational and compliance challenges it introduces.

FAQ

What is the main purpose of a parent company?

The main purpose of a parent company is to control one or more subsidiaries while maintaining separate legal entities. This allows businesses to manage strategy, risk, and growth across a group structure more effectively.

Is a parent company the same as a holding company?

No, a parent company and a holding company are not always the same. A holding company is a type of parent company that usually does not conduct operational activities, while many parent companies remain actively involved in trading and management.

Does a parent company need an LEI?

A parent company needs an LEI if it is required to participate in regulated financial transactions or reporting. In group structures, parent company information may also be relevant when subsidiaries obtain or maintain